2025 Construction Tech Request for Startups

Where insiders would like to see more startups and innovation

Welcome to a special mid-week edition of SandHill! In this post, we share sector-specific opportunities shaped by insights from investors & execs focused on the space. Interested in teaming up on a future post? Just hit reply to this email.This post is a collaboration with Last Week in ConTech, a construction tech newsletter highlighting the latest innovation in the sector.

The construction industry is facing a convergence of market forces that is opening unprecedented opportunities for new innovators. After years of slow adoption and fatigue with point solutions, insiders are now seeing real momentum amidst meaningful adoption of tech across the sector.

Given our shared excitement for the construction industry’s transformation, we set out to explore where investors, executives, and operators most want to see innovation. Our aim is to highlight the areas insiders believe hold the greatest potential for startups.

We drew on a panel of experts that includes operators on the front lines of building and investors backing the next wave of entrepreneurs. Their perspectives highlight where the need is most acute and where the opportunities are most compelling.

This is not meant to be an exhaustive list but rather a starting point that surfaces some of the most promising areas. If you see an angle we’ve missed or an area worth exploring, do reach out.

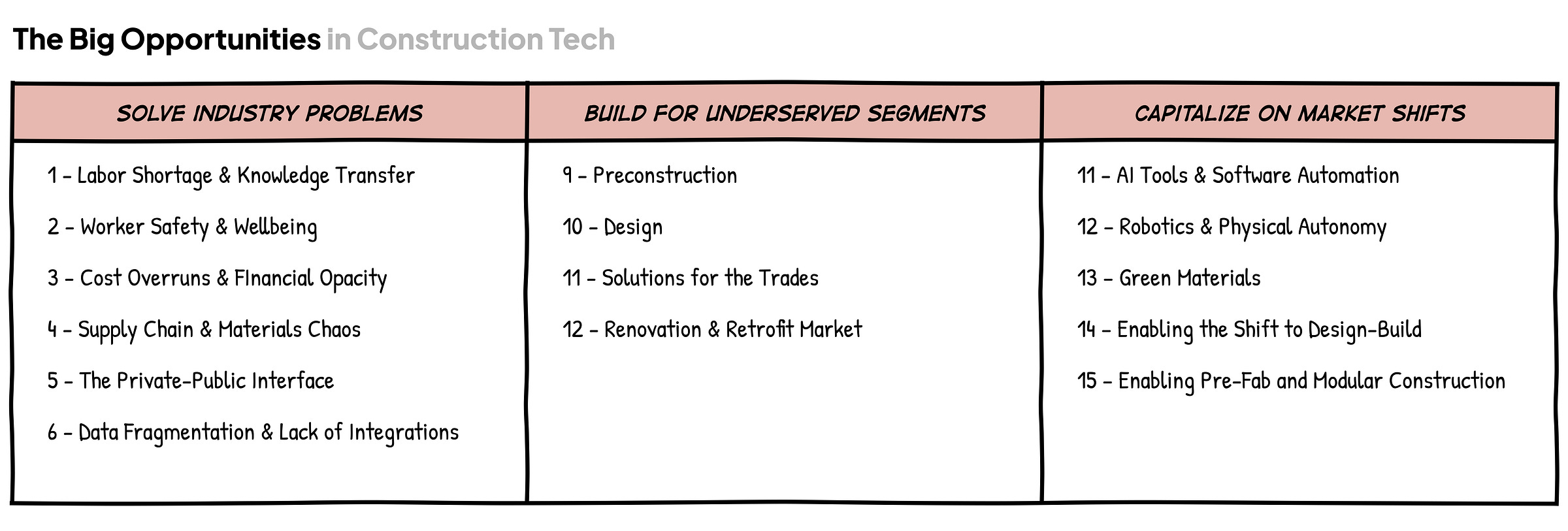

We found the experts highlighted 3 broad categories of opportunities, and we’ve broken out our post as such:

Unsolved, sector-wide challenges that require more innovation

Underserved market segments where innovation has barely scratched the surface

Opportunity areas to capitalize on market shifts and/or emerging technology

Problem Areas: Big Industry Pain Points Needing Solutions

Zone 1: Labor Shortage & Knowledge Transfer

Many of our experts highlighted the labor shortage problem as the most pressing challenge facing the construction industry. This shortage is compounded by the fact that older workers are retiring in large numbers, creating not only a gap in manpower but also a loss of accumulated expertise.

Kat Collins of 1Sharpe noted that retirements are happening without strong mechanisms for knowledge transfer. Diana Kay of Suffolk Tech reinforced that much of the most valuable knowledge in construction is gained through years of hands-on experience on job sites, not something that can be easily captured in manuals or training guides. Erin Khan added that much of this knowledge is passed down informally by word of mouth, underscoring the need for solutions that can preserve and maintain the high quality of builders’ expertise. As these experienced workers leave, the industry risks a massive skills gap that will be difficult to replace.

Even when skilled labor is available, it remains hard to access. Ben Sack of 53 Stations pointed out that construction lacks a central platform to connect workers and employers. Unlike white-collar professions that benefit from LinkedIn or Indeed, the trades still rely heavily on word of mouth and personal networks, making talent discovery slow and inefficient.

These gaps open the door for innovation. Solutions that attract and train new workers, capture and transfer the know-how of retiring experts, and make it easier to connect labor with job sites could have a transformative impact on the industry.

Zone 2: Worker Safety & Wellbeing

Safety and wellbeing remain among the most pressing challenges in construction. The industry consistently records one of the highest injury rates of any profession. While safety initiatives have expanded over the years, many solutions still focus on compliance and responding to incidents after they occur rather than predicting and preventing risks in advance.

The issue extends beyond physical harm. Construction workers experience elevated levels of stress, anxiety, and depression. The combination of dangerous work, high project pressure, and job site isolation contributes to one of the highest suicide rates across all professions. Mental health has often been overlooked, leaving a major gap in support systems.

Hamzah Shanbari of Haskell and Mike Heller of Navitas both highlighted that the sector has historically optimized processes around projects while neglecting the workers themselves. Burnout, stress, and overall wellbeing remain blind spots that directly affect retention and productivity.

This gap creates a clear opportunity for innovation. With labor shortages intensifying, companies are increasingly open to investing in tools that enhance both physical safety and mental health. Solutions that integrate proactive safety monitoring with mental health support and broader worker experience improvements can deliver meaningful value to employers and workers alike.

Zone 3: Cost Overruns & Financial Opacity

Cost overruns are rampant in construction, yet current tracking tools provide neither the real-time visibility to prevent them nor the financial intelligence to manage them when they occur. Mauricio Weiss of Zacua noted that progress tracking rarely incorporates financial analysis, leaving teams unable to weigh cost trade-offs such as whether a schedule delay might ultimately be financially beneficial (for example, if completing a month later results in a 30% reduction in subcontractor costs).

Data capture bottlenecks compound the problem. As Diana Kay of Suffolk Tech observed, today’s systems of record often require manual input, an unrealistic expectation on job sites where workers are focused on completing their tasks rather than logging information.

The stakes are high. Ben Sack of 53 Stations quoted one of his portfolio CEOs as saying, “more contractors go out of business from gluttony than starvation”- not because they can’t find work, but because they take on the wrong jobs and mismanage working capital. Margin erosion, payment delays, and cash flow volatility bring down far more firms than an empty pipeline. Without real-time financial controls and visibility into project profitability, contractors are effectively flying blind.

Erin Khan noted that most tools today only track costs after the fact, when the real need is proactive scenario analysis that can predict how choices will affect schedules and budgets before problems emerge.

Raja Ghawi of Era Ventures added that the challenge goes even deeper: many of the industry’s financial pain points are profitable for incumbents. Payment delays, for example, are often used by GCs and owners as leverage over subcontractors. This dynamic creates structural resistance to transparency, explaining why repeated attempts to solve long payment cycles with fintech or lending products have struggled to scale.

New technology, however, is shifting what’s possible. Advances in voice capture, computer vision, and large language models promise to simplify how construction teams interact with software. Companies that can leverage these tools to passively capture progress and deliver ongoing financial analysis have the potential to turn reactive tracking into proactive management, protecting margins and preventing costly mistakes.

Zone 4: Supply Chain & Materials Chaos

Supply chain visibility has become a pressing priority in construction. John Andres of Provizual noted that contracts are now putting real impetus on contractors to be proactive, checking in regularly on supply chain status, following up with warehouses, and doing everything possible to mitigate delays.

Despite this urgency, the industry still lacks a dominant solution. Mauricio Weiss of Zacua emphasized that while there has been significant activity, no one has truly cracked the marketplace and procurement flows in construction. Mike Heller of Navitas added that solving the problem is not just about visibility; it is about making sure what is happening on site connects directly with the schedule, and ensuring the supply chain can adapt to those changes in real time.

Raja Ghawi of Era Ventures highlighted a parallel opportunity: the potential for platforms that help source materials internationally, particularly in the face of global tariffs. By tapping suppliers from across the globe, these models can offer contractors both resilience and cost savings. The fragmented nature of the market could make it especially well-suited for marketplaces that consolidate options, maintain quality, and reduce costs.

Overall, the supply chain represents one of the biggest areas for innovation, with opportunities ranging from end-to-end tracking systems to intelligent procurement platforms that connect jobsite realities with global trade dynamics.

Zone 5: The Private-Public Interface

Government permitting and approvals are among the largest sources of project delays in construction. Complex regulatory requirements often slow down contractors, while government agencies themselves struggle with manual, resource-constrained review processes. The result is inefficiency on both sides and projects that take months longer than planned.

Kat Collins of 1Sharpe noted that contractors are increasingly turning to AI-driven solutions to bridge the gap between being permit-ready and securing approvals. This points to a broad opportunity for tools that streamline how contractors and government agencies interact.

The landscape includes interface optimization tools that improve submissions and communications, backend automation that integrates with government systems like Tyler Technologies and Accela, and platforms such as Infila that help planning departments standardize interpretations of zoning and building codes. Each approach targets different friction points but ultimately addresses the same bottleneck.

Solutions that improve efficiency in permitting carry outsized value. By reducing project delays, cutting administrative costs, and ensuring compliance, these tools create clear ROI for both contractors and municipalities. In an industry where delays quickly compound into significant financial impacts, platforms that can shave weeks or months off approval timelines represent one of the most promising areas for innovation.

Zone 6: Data Fragmentation & Lack of Platform Integration

The industry has gotten overreliant on point solutions in the past five years, highlighted Ben Sack of 53 Stations. Covid acted as a catalyst for technology adoption, but the result was a proliferation of small tools designed to solve narrow pain points, and now firms are juggling dozens of solutions which don’t communicate with each other.

This fragmentation has shifted buyer expectations. Decision makers now treat data compatibility and robust API endpoints as a baseline requirement, often refusing to consider new tools unless they can consolidate or replace existing ones. The result is a growing opportunity for major platform plays. While Procore dominates construction and Autodesk leads on the design side, the space between design and construction remains fragmented.

This issue goes deeper than tool sprawl. As Mike Heller of Navitas and Erin Khan pointed out, there is still no central, reliable source of truth for design information. Discrepancies between specifications, drawings, and BIM models result in rework and delays on-site while fragmented design data means teams repeatedly solve the same problems rather than building on a consistent foundation.

Success here means building platforms that not only consolidate multiple point solutions but also intelligently process voice, images, PDFs, and handwritten notes. These are the messy, unstructured streams of information that flow through construction projects but have never been captured systematically.

Opportunity Areas: Underserved Segments

Zone 7: Preconstruction

Preconstruction, according to Ben Sack of 53 Stations, remains a bit like the wild west. Contractors juggle a patchwork of estimating tools, homegrown spreadsheets, and ad hoc processes, but the market is ripe for a true platform play - an integrated system that centralizes workflows, data, and collaboration.

At the same time, complexity in this phase has grown significantly. Projects now demand greater collaboration, transparency, and planning before ground is broken, which makes upfront coordination essential to delivering on time and on budget.

Mauricio Weiss of Zacua and Hamzah Shanbari of Haskell noted that design-build contracts are becoming increasingly common in the industry. In this model, the contractor is responsible for both design and construction, shifting their role from being price takers, who simply price someone else’s design, to price makers, who shape design and cost together.

Diana Kay of Suffolk Tech highlighted the value of shortening this phase as preconstruction can often take longer than construction itself. Automating design and estimation tasks can help streamline workflows and free up resources. Solutions that reduce time spent on repetitive and manual work in this phase are particularly valuable.

Taken together, preconstruction is becoming more critical than ever and as a result contractors increasingly need sophisticated capabilities. The platform opportunity in preconstruction spans estimating, takeoffs, value engineering, cost prediction, and collaboration tools that bring owners, contractors, architects, and engineers together while decisions still have the greatest impact on outcomes.

Zone 8: Design

Design is seeing a lot of disruption, with increasing opportunities for design automation, notes Hamzah Shanbari of Haskell. There are opportunities to automate tedious tasks that practitioners would prefer not to do manually. For example, tasks such as autorouting of ductwork, conduit, and other building systems could be handled concurrently by AI to reduce errors and clashes.

But there’s a fundamental interoperability problem hampering preconstruction workflows. As Mike Heller of Navitas notes, architects and engineers often work in software that contractors and other stakeholders cannot easily access, which forces inefficient file conversions and data loss. For example, a 2D PDF drawing may need to be exported from a Revit model.

This fragmented data environment creates downstream issues. Without a central, reliable source of truth for design information, discrepancies between specifications, drawings, and BIM models cause costly rework and project delays. Addressing interoperability and data fragmentation is as critical as automation itself.

The design opportunity lies in building platforms that integrate generative design, AI-powered MEP routing, conflict resolution, and better data-sharing frameworks to create a single source of truth across all stakeholders.

Zone 9: Solutions for the Trades

Much of the innovation in the past two decades has targeted general contractors, but there is a growing opportunity to build solutions for the trades. Ben Sack of 53 Stations noted that the trades are becoming more sophisticated, increasingly value tech-driven ROI, and represent an untapped market for direct adoption.

The market itself remains massive but underserved. Ben explained that most technology is still GC-focused because GCs often sit in the driver’s seat and can mandate tools down the chain. While this makes sense, he argued that solutions purpose-built for the trades remain an unsolved area and one he would like to see more innovation in.

Diana Kay of Suffolk Tech echoed this point, highlighting that many subcontractors, some of them large companies, still rely on fragmented systems or, in some cases, no systems at all. Subcontractors need trade-specific project management, specialized inventory management, business intelligence tools, and solutions that understand their unique cash flow challenges and operational complexity.

Ben underscored that working capital is another critical underserved need. Subcontractors must bid for jobs, pay employees, and purchase materials up front, yet they may not receive payment from the GC until months later, when a project is completed.

Raja Ghawi of Era Ventures pointed out another barrier: misaligned incentives. Construction is structured so that workers and subs are paid hourly, often benefiting more from overtime than efficiency. This incentive structure helps explain why many “productivity” solutions fail to gain adoption. For new technologies to succeed with the trades, they must either align with these incentives or rewire them in ways that create clear, tangible upside for subs and workers.

Zone 10: Renovation & Retrofit Market

A growing amount of construction spend is on renovations, notes Mauricio Weiss of Zacua, and yet most innovation is aimed at new builds.

While there is a growing amount of solutions focused on energy retrofits, buoyed by regulation such as the EU’s Energy Performance of Buildings Directive (EPBD), which requires 16% of the worst-performing non-residential buildings to be renovated by 2030, and 26% by 2033, retrofit-focused solutions outside this scope remain scarce as building stock continues to age.

Adding to this is the EU’s “no net land take by 2050” objective, which aims to end expansion onto undeveloped land across member states. Any new land developed (e.g., cities, infrastructure) should be compensated for by restoring or re-naturalizing an equivalent amount of previously developed or degraded land. While this goal is a non-binding EU recommendation, countries such as France and regions within Italy and Belgium have adopted variations. It would shift demand away from greenfield development toward densification, redevelopment, and renovation of existing assets.

The opportunity is substantial because renovation projects have unique challenges that new construction tools don’t address well. These include existing building assessment, working with incomplete or outdated documentation, managing occupied spaces, dealing with unknown conditions discovered during work, and coordinating around existing building systems.

Companies that can build renovation-first solutions rather than adapting new construction tools will find a massive, underserved market with different pain points and procurement processes.

Opportunity Areas: Capitalize on Market Shifts

Zone 11: AI Tools & Software Automation

Current AI adoption in construction is still dominated by chat-based LLMs that provide conversation but not tangible task completion. John Andres of Provizual argued that the real need is AI capable of executing workflows and completing processes, moving beyond information delivery to true task automation.

Diana Kay of Suffolk Tech described this shift as the move toward “agentic workflows,” where AI actively completes tasks rather than serving as a passive assistant. Diana also emphasized that construction generates enormous amounts of unstructured data that current systems cannot process effectively. Much of this information is never captured, since systems of record depend on manual input that is unrealistic on busy job sites.

According to Diana, emerging AI capabilities can help overcome these bottlenecks. Voice interfaces, image recognition, computer vision, and LLMs that add context and understanding can simplify how workers interact with technology in real time.

Hamzah Shanbari of Haskell highlighted voice as a particularly compelling opportunity. Workers often fall back on familiar routines when faced with complex interfaces, but a conversational system that automatically logs daily activity into structured reports could dramatically reduce friction and boost adoption.

The key, Diana concluded, is building AI that integrates seamlessly into existing workflows and delivers real outcomes. Many emerging companies are starting to think this way, but the real opportunity lies in developing AI that completes processes end-to-end rather than merely assisting with them.

Zone 12: Robotics & Physical Autonomy

Construction robots are nearing an inflection point that could disrupt entrenched equipment manufacturers. Raja Ghawi of Era Ventures noted that giants like Caterpillar and John Deere, despite their massive market capitalizations, have done little in terms of R&D and new product development beyond basic electrification for decades, leaving them vulnerable to robotics-focused challengers.

He sees opportunity both in creating new robotic equipment and in retrofitting existing machines. One of his recent investments converts human-operated equipment into autonomous systems, showing how innovation can leverage the installed base rather than requiring full replacement.

The most compelling use cases, Raja argued, lie in automating repetitive, dangerous, or undesirable tasks. Just as cranes eliminated the need for crews to haul materials by hand, robotics can remove jobs that are unsafe or unattractive. But as John Andres of Provizual pointed out, workers are often less concerned about robots taking their jobs than they are interested in robots that can augment their work. Building on this, Kat Collins of 1Sharpe emphasized that robotics can also support workers on-site by making certain tasks easier or enabling less-skilled workers to take on jobs that would traditionally require more advanced expertise. Together, safety gains and relief from labor shortages will accelerate adoption and ease concerns about robots replacing humans on-site.

Perhaps most transformative, robotics could enable new business and service delivery models. Raja pointed to the potential for robotics-first subcontractors that deploy fleets of autonomous machines across geographic boundaries, a shift from today’s subs limited by human labor.

In a labor-constrained industry, robotics and autonomy have the potential to unlock enormous productivity gains.

Zone 13: Green Materials

The construction industry’s reliance on traditional materials creates both environmental and economic pressures that alternative materials could help address. Raja Ghawi of Era Ventures emphasized the complexity of this space, noting that even within his team, there are ongoing debates about which innovations in concrete, glass, or plastics will truly gain traction, and he questioned whether these breakthroughs will appear first in mainstream construction.

The challenge is risk tolerance. Raja highlighted that contractors are reluctant to risk using a new form of concrete without proof that it will last the full design life of a building. Contractors want to prove longevity prior to utilizing it within a high-risk scope. While some innovators may be willing to assume the risk, the timeline for proving durability in core structural materials is inevitably long.

At the same time, market forces are mounting. Rising material costs, supply chain disruptions, and environmental regulations for lowered carbon emissions are pushing the industry to explore alternatives. Carbon-negative materials, recycled content, and prefabricated systems that reduce on-site labor are beginning to gain attention despite the industry’s traditional conservatism.

The adoption curve will likely begin in lower-risk applications such as interior finishes, temporary structures, or specialty components before expanding into structural elements. Companies that can pair strong long-term performance data with clear cost or performance advantages will be best positioned to overcome the industry’s risk aversion.

Zone 14: Enabling the Shift to Design-Build

The construction industry is undergoing a fundamental shift toward design-build contracts, where contractors assume design responsibilities that were traditionally handled by separate architectural and engineering firms. Mauricio Weiss of Zacua highlighted that contractors are increasingly pushing this model, and as contracts evolve, the value of preconstruction solutions grows.

This shift is also creating integrated workflow opportunities that did not exist when design and construction were managed separately. Ben Sack of 53 Stations pointed out that there is still no dominant platform serving the critical space between design and construction. As contractors take on greater design responsibility, he argued, they require more sophisticated tools to manage the full process from design through delivery.

The design-build model also demands new types of collaboration tools, integrated project delivery platforms, and risk management systems. Traditional handoffs between design and construction become internal workflows that can be optimized for speed, coordination, and accountability.

Companies that design specifically for the design-build model, rather than attempting to bridge separate tools, are best positioned to capture the efficiency gains promised by this integrated approach. The opportunity spans project management platforms, risk allocation tools, integrated design-construction workflows, and financial management systems capable of managing the complexity of bundled services.

Zone 15: Enabling Pre-Fab and Modular Construction

Prefabrication has been gaining traction, but primarily among large, sophisticated contractors with the capital and expertise to manage complex factory-to-site coordination. Companies like Skanska, Turner, and DPR have embraced factory-based production for everything from bathroom pods to entire building facades, but this adoption has been concentrated among players who can afford dedicated prefab teams and custom logistics operations.

The barrier isn’t just financial. Prefab requires fundamentally different skillsets than traditional construction. Success demands expertise in manufacturing planning, supply chain coordination, modular design principles, and precision logistics. This has created a two-tier market where large players capture prefab’s advantages while smaller contractors remain locked out.

Kat Collins of 1Sharpe highlighted the democratization opportunity. She noted that if prefab could be simplified to the point where building a home resembled assembling IKEA furniture, it would reduce the need for highly skilled labor and make it easier to guide less experienced workers. This, she argued, could significantly improve labor availability across the industry.

The technology gap centers on accessibility. Companies that can package the complexity of prefabrication into simpler, more user-friendly solutions stand to democratize adoption for small and mid-market contractors, broadening prefab’s impact across the construction ecosystem.

Looking Ahead

Construction has long been a tech laggard, but a confluence of forces such as labor pressures, shifting delivery models, and new advances in AI and automation are creating massive catalysts for change. These dynamics are opening the door for a new generation of upstarts to not only capitalize on the opportunity but also transform the industry for the better for all stakeholders in the years to come.

This list is meant as a starting point, not a complete map. If you’re building in these areas or see zones we may have missed, we’d love to hear from you. Please reach out to us!

Expert Contributors

Thank you to the industry insiders who shared their insights:

Ben Sack - Investor at 53 Stations, which invests in early-stage technology companies in sectors aligned with The Pritzker Organization (TPO) portfolio, including built world, healthcare, and wealth management. We support founders with a service provider mindset, an expansive network of advisors and customers, and access to TPO to invest across opportunities and timeframes. TPO construction companies include Lithko Contracting and STV Inc. Get in touch via email at benjamin@53stations.com.

Diana Kay - Partner at Suffolk Technologies, a venture capital firm investing in early-stage companies transforming the construction, real estate, and infrastructure industries. Deploying out of a $110M fund, the firm has invested in over 55 companies since 2019 and runs the acclaimed BOOST accelerator.

Erin Khan - Founder of Erin Khan Consulting, where she provides technology and innovation services to contractors and ConTech startups. Previously, she was National Director of Construction Solutions at Suffolk Construction.

Hamzah Shanbari - Director of Innovation at Haskell, an AEC and consulting firm which delivers over $2+ billion annual revenue. He is also the author of Paperless Builders, a guide to transforming construction through technology.

John Andres - Founder & CEO at Provizual, an inspection visualization tool for the construction industry. Previously he was Director of Technology at ANDRES Construction Services.

Kat Collins - Partner at 1Sharpe Capital, an investment firm taking multi-strategy approach to back and build businesses bringing the largest offline industries online.

Mauricio Weiss - Founding Partner at Zacua Ventures, a global early-stage venture focused on investments in the Built Environment.

Raja Ghawi - Partner at Era Ventures, an engineer with a passion for great literature. He is particularly excited to partner early with founders taking on gnarly and complex new business models.

Mike Heller - Principal at Navitas Capital, an early stage venture capital firm specializing in technology for the built world and foundational industries.

Let’s goooo